BOCHK Loan Document Review System

Designed a loan document analysis tool for Bank of China (Hong Kong), enabling automatic comparison between the term sheet and the loan agreement to improve analyst efficiency and reduce risk.

The Challenge: Manual Loan Document Review Bottlenecks at BOCHK

BOCHK faced significant operational hurdles due to the manual comparison process for loan documents (term sheets vs. loan agreements). This traditional method was a major pain point for their analysts and the institution:

01Time-Consuming

- 8 hours to review one document set

- 5–8 files per analyst per week

- Repeated checks on key terms

02Error-Prone

- 3–5 critical differences often missed

- Complex terms easily misread

- Fatigue increased late-stage errors

03Hard to Train

- 2-3 months to train new hires

- All work reviewed by senior staff

- High reliance on experience

The Solution

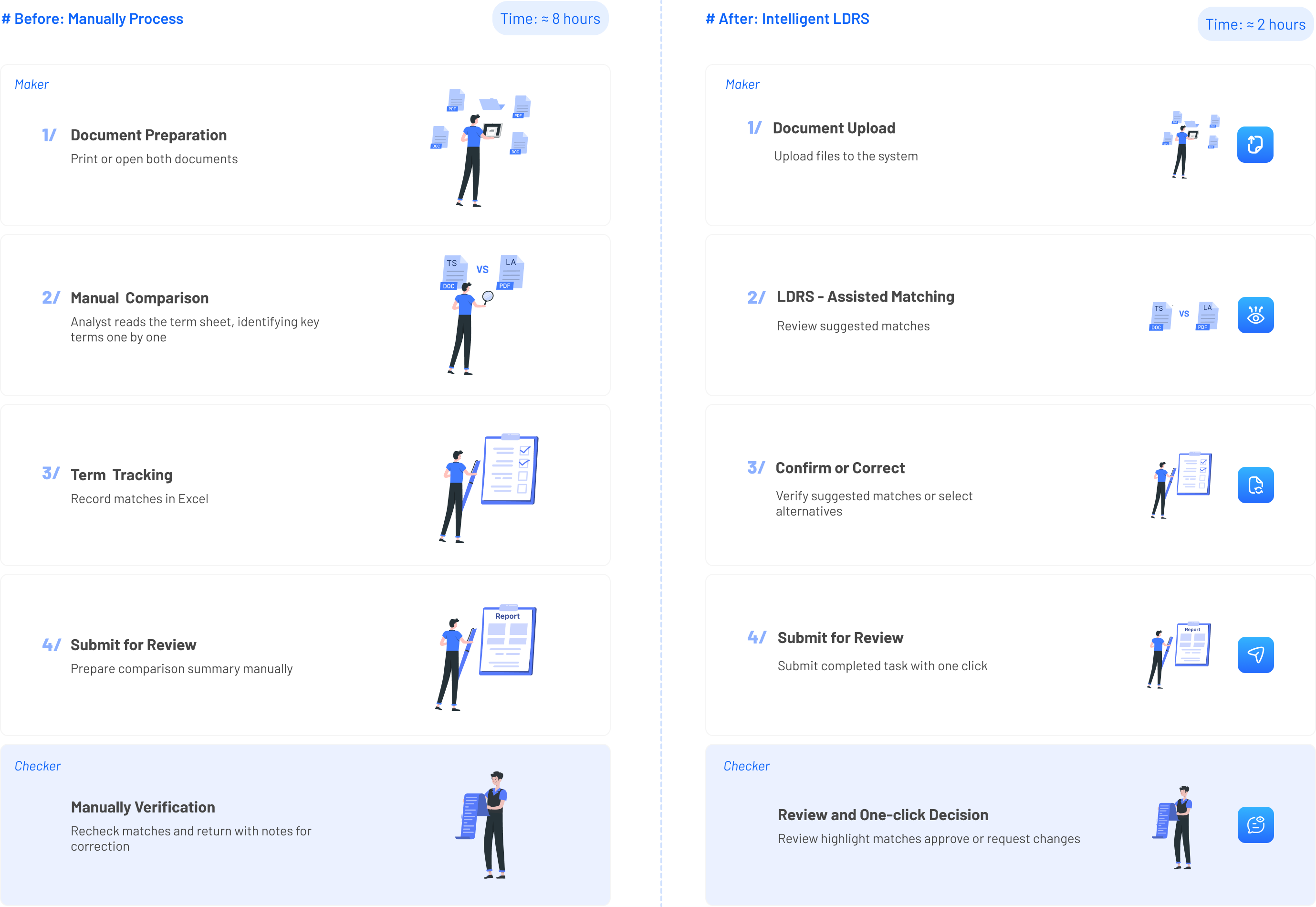

To address these critical needs, we designed and developed a Loan Document Review System. The tool fundamentally transforms the laborious document comparison workflow, as illustrated below:

The new workflow streamlines collaboration between analysts (Makers) and reviewers (Checkers) through intelligent automation:

For Analysts (Makers):

- Easy Upload: Just upload the term sheet and loan agreement.

- Smart Matching: The system compares documents and suggests clause matches with key differences highlighted.

- Guided Review: Analysts confirm or adjust matches with clear guidance.

- Quick Submission: A summary is generated for one-click handoff to the reviewer.

For Reviewers (Checkers):

- Efficient Review: See confirmed matches and key differences in one view.

- Fast Decisions: Approve or request changes with a single click.

Key Features & Functionality

Intelligent Document Upload and Auto-Recognition: Analysts upload documents, and the system auto-detects structure and key clauses—ready for comparison with minimal effort.

Clause Matching and Comparison View: Automatically finds related clauses, highlights changes, and shows before and after versions to make review easy.

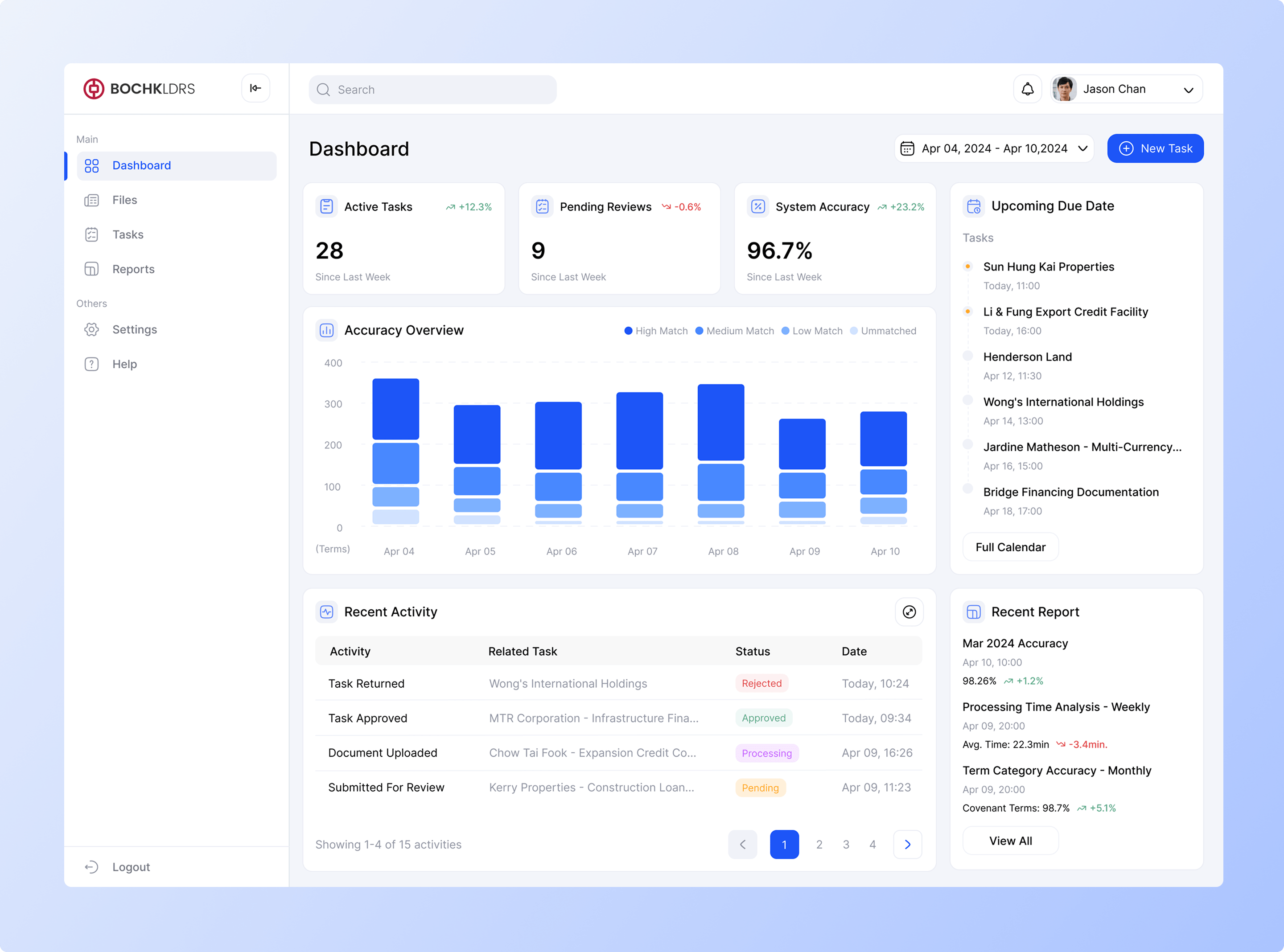

Intuitive Dashboard: Gives analysts and managers a clear view of document status, flagged issues, and team progress to support better workflow management.

Outcomes & Reflections

1. Exceeding Accuracy Targets

We successfully achieved a 95% recognition accuracy, significantly reducing the manual workload for front-line staff.

2. Designing for the "Last Mile"

The biggest UX value wasn't just displaying correct data, but handling the incorrect data. The streamlined Validation Interface empowers staff to quickly identify and fix the 5% of errors, ensuring zero compliance risks.

3. Scalable Framework

The component-based UI is ready to be extended to other banking processes, such as corporate account opening or mortgage document processing.